Navigating Subscription Revenue Recognition: Best Practices for SaaS Businesses

Subscription revenue recognition is a crucial aspect for SaaS businesses, and implementing best practices in this area can lead to accurate financial reporting and better decision-making. According to industry research, the SaaS market is expected to reach $278 billion by 2023, indicating its significance in the business landscape.

- One best practice is to adopt a clear and consistent revenue recognition policy. This involves defining the criteria for recognizing subscription revenue, such as when it can be considered earned and realizable. Aligning with recognized accounting standards, such as ASC 606 or IFRS 15, ensures compliance and consistency.

- Another essential practice is to measure and track performance obligations accurately. Identifying distinct elements within a subscription, like implementation or professional services, helps allocate revenue appropriately. It allows for proper recognition based on completing these obligations, enhancing transparency and accuracy.

- Furthermore, monitoring customer usage and engagement can provide valuable insights. Tracking metrics like active users, feature adoption, or utilization rates can aid in understanding customer behavior and identifying upsell or cross-sell opportunities. This data-driven approach helps optimize revenue generation and enhances customer satisfaction.

SaaS businesses can navigate subscription revenue recognition effectively by adopting best practices such as clear policies, accurate performance obligation measurement, and leveraging customer usage data. By implementing these practices, SaaS businesses can ensure accurate financial reporting, make informed decisions, and thrive in the rapidly expanding market.

Introduction to Subscription Revenue Recognition

Subscription revenue recognition is a critical accounting process that involves recognizing and reporting revenue generated from subscription-based business models. With the rise of Software as a Service (SaaS) and other subscription-based industries, understanding and implementing proper revenue recognition practices has become essential for accurate financial reporting and compliance.

The concept of subscription revenue recognition revolves around when and how revenue should be recognized throughout a subscription. Unlike traditional product sales, where payment is recognized upfront, subscription revenue is typically recognized over time as services are delivered to the customer.

Recognizing subscription revenue involves considering contract terms, performance obligations, and allocation. Companies must adhere to accounting standards such as ASC 606 (Revenue from Contracts with Customers) in the United States or IFRS 15 (Revenue from Contracts with Customers) internationally, which provide guidelines for recognizing revenue from contracts.

By following best practices in subscription revenue recognition, businesses can ensure accurate financial reporting, maintain transparency, and make informed decisions based on reliable revenue data. It also helps evaluate the company’s health, forecast future cash flows, and assess the effectiveness of pricing strategies.

Understanding Subscription Revenue Recognition

Subscription revenue recognition refers to accounting for and reporting revenue generated from subscription-based business models. It is crucial for accurately tracking and reporting revenue in industries such as Software as a Service (SaaS), media streaming, or membership-based services.

In traditional sales models, revenue is recognized upfront when a product or service is sold. However, in subscription-based models, payment is typically recognized over some time as the subscription progresses.

To understand subscription revenue recognition, it is essential to consider critical elements:

- Contractual Arrangements: The terms and conditions of the subscription agreement define the rights and obligations of both the provider and the customer. This includes pricing, duration, payment terms, and additional services or features.

- Performance Obligations: Subscription contracts often involve multiple performance obligations, such as software access, customer support, or regular content updates. Revenue recognition is based on satisfying these obligations over time or at specific milestones.

- Revenue Allocation: When a subscription includes different elements, such as software and implementation services, revenue needs to be allocated appropriately to each component based on their standalone selling prices. This ensures accurate recognition of revenue related to each element.

- Recognition Methods: Various methods can recognize subscription revenue, such as straight-line recognition, usage-based recognition, or milestone-based recognition. The appropriate way depends on the subscription agreement’s specifics and the business’s nature.

Compliance with accounting standards, such as ASC 606 or IFRS 15, is essential for accurate revenue recognition. These standards provide guidelines on when and how to recognize revenue from customer contracts.

By understanding the principles and complexities of subscription revenue recognition, businesses can ensure proper financial reporting, compliance with accounting standards, and informed decision-making regarding pricing, customer acquisition, and overall business strategy.

Significance of Proper Revenue Recognition

Proper revenue recognition holds significant importance for businesses across various industries. Here are key reasons why accurate and appropriate revenue recognition is crucial:

- Financial Reporting: Revenue recognition is a fundamental component of financial reporting. Properly recognizing revenue ensures the accuracy and reliability of financial statements. It provides stakeholders, such as investors, creditors, and analysts, with a clear and transparent view of a company’s economic performance.

- Compliance with Accounting Standards: Adhering to recognized accounting standards, such as ASC 606 (in the United States) or IFRS 15 (internationally), is essential for compliance. These standards provide guidelines on revenue recognition, ensuring consistency and comparability among companies. Observation not only demonstrates transparency but also mitigates the risk of non-compliance penalties.

- Decision-Making: Accurate revenue recognition enables informed decision-making. By clearly understanding revenue streams and their timing, businesses can assess the organization’s financial health, evaluate the effectiveness of pricing strategies, and make data-driven decisions about resource allocation, investments, and growth strategies.

- Investor Confidence: Investors rely on accurate financial information to evaluate the performance and potential of a company. Proper revenue recognition enhances investor confidence by providing reliable and transparent financial data. This can positively impact a company’s ability to attract investments, secure funding, and build strong stakeholder relationships.

- Regulatory Compliance: Revenue recognition plays a crucial role in meeting regulatory requirements. Proper compliance ensures that businesses adhere to industry-specific rules, reducing the risk of legal and regulatory issues. Healthcare, telecommunications, and technology industries have specific revenue recognition regulations.

- Valuation and M&A Activities: Accurate revenue recognition is vital during valuation and merger and acquisition (M&A) processes. Properly recognizing revenue provides a clear picture of a company’s financial performance, which impacts its valuation and attractiveness to potential buyers or partners. Inaccurate or questionable revenue recognition practices can raise red flags and hinder deal negotiations.

Proper revenue recognition is essential for financial reporting accuracy, regulatory compliance, informed decision-making, investor confidence, and successful M&A activities. By following recognized accounting standards and best practices, businesses can ensure transparency, reliability, and the ability to make strategic decisions based on sound financial information.

Best Practices for Subscription Revenue Recognition

Implementing best practices for subscription revenue recognition is crucial for accurate financial reporting and compliance. Here are some key best practices to consider:

- Adopt Recognized Accounting Standards: Follow established accounting standards such as ASC 606 (in the United States) or IFRS 15 (internationally) to ensure compliance and consistency in revenue recognition. These standards guide recognizing revenue from contracts with customers.

- Define Clear Revenue Recognition Policies: Establish clear and consistent revenue recognition policies specific to your business. These policies should outline the criteria for recognizing revenue, such as when it is considered earned and realizable. Communicate these policies to stakeholders to ensure understanding and adherence.

- Identify Performance Obligations: Identify and separate distinct performance obligations within the subscription agreement. This involves determining separate elements, such as software access, implementation services, or ongoing support. By identifying performance obligations, you can allocate revenue appropriately based on the completion of each debt.

- Allocate Revenue Fairly: When a subscription includes multiple components, such as software and additional services, allocate revenue fairly to each element based on their standalone selling prices. This ensures accurate recognition of revenue related to each element, providing transparency and compliance with accounting standards.

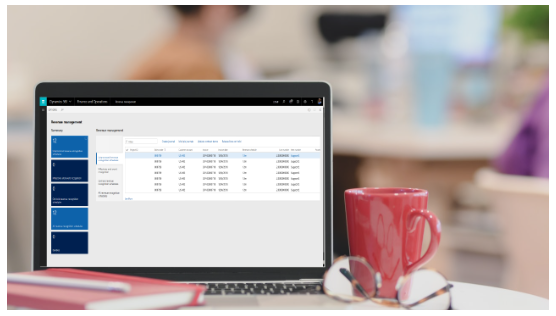

- Monitor Customer Usage and Engagement: Track and analyze customer usage data to gain insights into customer behavior and engagement. Metrics such as active users, feature adoption rates, or utilization patterns can inform decision-making and help identify opportunities for upselling, cross-selling, or enhancing customer satisfaction.

- Regularly Review and Update Revenue Recognition Practices: Revenue recognition practices should be periodically reviewed and updated to reflect changes in business models, pricing structures, or accounting standards. Stay informed about any updates or changes in the applicable accounting standards and adapt your practices accordingly.

- Document and Disclose Revenue Recognition Methods: Maintain thorough documentation of your revenue recognition methods and processes. This documentation is crucial for audit purposes and provides transparency to external auditors, stakeholders, and regulatory bodies. Disclose revenue recognition policies and procedures in financial statements to enhance transparency and compliance.

By following these best practices, businesses can ensure accurate and transparent subscription revenue recognition, enabling reliable financial reporting, compliance with accounting standards, and informed decision-making.

Aligning with Revenue Recognition Standards

Aligning with revenue recognition standards is crucial for accurate financial reporting and compliance. Here are vital steps to ensure alignment with recognized standards such as ASC 606 or IFRS 15:

- Understand the Standards: Familiarize yourself with the specific revenue recognition standard applicable to your business, whether ASC 606 (the Financial Accounting Standards Board’s revenue recognition standard in the United States) or IFRS 15 (the International Financial Reporting Standards Revenue recognition standard internationally). Study the principles, guidelines, and implementation requirements outlined in the middle.

- Assess Impact on Current Practices: Evaluate how the standard impacts your revenue recognition practices. Identify areas where changes are needed to align with the standard’s requirements. This assessment may involve reviewing existing contracts, revenue streams, and revenue recognition methods to ensure compliance.

- Identify Performance Obligations: Review your contracts to identify distinct performance obligations. A performance obligation is a promise to transfer goods or services to a customer. Define and separate each commitment within the agreement. This step is crucial for allocating revenue based on the completion of each obligation.

- Determine Transaction Price: Determine the transaction price, which is the amount expected to be received from the customer in exchange for goods or services. The standard guides estimate and allocate the transaction price appropriately. Consider factors like variable consideration, discounts, and non-cash consideration.

- Recognize Revenue Over Time or at a Point in Time: Determine whether revenue should be recognized over time or at a specific point based on the nature of the performance obligations. Consider factors such as the transfer of control, customer acceptance criteria, and the passage of time. Apply the appropriate recognition method outlined in the standard.

- Document and Disclose: Maintain detailed documentation of your revenue recognition policies, procedures, and judgments made in applying the standard. This documentation is evidence of compliance during audits and helps ensure transparency and consistency. Disclose the significant decisions and estimates made in revenue recognition in your financial statements.

- Stay Updated and Seek Professional Guidance: Revenue recognition standards may evolve. Stay updated on any amendments, interpretations, or changes to the standards. If needed, consult with accounting professionals or seek external expertise to ensure an accurate understanding and application of the standards.

By aligning with recognized revenue recognition standards, businesses can enhance financial reporting accuracy, comply with regulatory requirements, and provide stakeholders with transparent and comparable financial information.

Determining Performance Obligations and Revenue Timing

Determining performance obligations and revenue timing is a critical aspect of revenue recognition. Here’s a step-by-step guide to help you navigate this process effectively:

- Identify the Contract: Identify the contract between your business and the customer. A contract can be written, oral, or implied by customary business practices. It should include agreed-upon terms and conditions, such as the scope of services, pricing, and payment terms.

- Identify Performance Obligations: The distinct promises within the contract create obligations to transfer goods or services to the customer. Performance obligations are the specific activities or deliverables expected of the customer. Customary business practices or legal requirements can explicitly state or imply these.

- Evaluate Separability: Assess whether each performance obligation is separable from the other duties within the contract. A performance obligation is considered separable if the customer can benefit from it independently or if another party can provide it. If detachable, each obligation is accounted for as a separate unit of account.

- Determine Transaction Price: Determine the transaction price, which is the consideration expected from the customer in exchange for fulfilling the performance obligations. Consider any variable or contingent consideration, discounts, rebates, or non-cash components that may impact the overall transaction price.

- Allocate Transaction Price: Allocate the transaction price to each separate performance obligation based on their relative standalone selling prices. If the standalone selling price is not observable, estimate it is using acceptable methods, such as cost plus a margin or a market assessment approach.

- Recognize Revenue Timing: Determine when to recognize revenue for each performance obligation. Revenue is recognized over time or at a specific point, depending on the nature of the performance obligation and the transfer of control to the customer. Factors to consider include the customer’s simultaneous receipt and consumption of the benefits, the passage of time, and the satisfaction of specific criteria or milestones.

- Ongoing Evaluation: Continuously monitor the performance of obligations and any changes in the contract terms. Adjust revenue recognition as needed to reflect changes in version or the satisfaction of commitments over time.

It’s important to note that revenue recognition is a complex area, and professional judgment may be necessary to navigate specific scenarios. Consulting with accounting professionals or seeking external expertise can help ensure the accurate determination of performance obligations and revenue timing in compliance with recognized accounting standards, such as ASC 606 or IFRS 15.

Managing Changes and Modifications

Managing changes and modifications effectively is crucial for maintaining compliance, accuracy, and operational efficiency. Whether it’s changed to processes, policies, systems, or documents, here are some critical considerations for managing changes and modifications:

- Change management process: Establish a structured change management process that outlines how changes are identified, assessed, approved, implemented, and monitored. This process should include clear roles and responsibilities, checkpoints, and documentation requirements.

- Change identification: Develop mechanisms to identify and capture change requests or suggestions from employees, customers, stakeholders, or regulatory bodies. Encourage open communication and provide channels for submitting change requests.

- Change impact assessment: Assess the potential impact of proposed changes on various aspects such as compliance, operations, resources, stakeholders, and systems. Consider each change’s risks, benefits, costs, and feasibility to make informed decisions.

- Documentation and communication: Document proposed changes, including the rationale, requirements, and expected outcomes. Communicate these changes effectively to all relevant stakeholders, ensuring clarity and addressing concerns or questions.

- Review and approval: Establish a formal review and approval process for changes. Involve key stakeholders, subject matter experts, and decision-makers to evaluate the proposed changes thoroughly. Obtain necessary approvals based on the established criteria and consider potential implications on compliance and accuracy.

- Testing and validation: Conduct thorough testing and verification before implementing changes to ensure they function as intended and do not introduce unintended consequences. Test in controlled environments and consider using prototypes, pilot projects, or simulations to assess the impact of changes before full-scale implementation.

- Training and readiness: Provide training and support to employees affected by the changes. Ensure they understand the changes’ purpose, scope, and impact and have the necessary knowledge and skills to adapt to the new processes or systems.

- Implementation and monitoring: Execute the approved changes according to the established plan. Monitor the implementation process closely to identify any issues, risks, or deviations from the intended outcomes. Regularly review and assess the effectiveness of the changes post-implementation.

- Documentation updates: Update relevant documentation, policies, procedures, and other records to reflect the approved changes accurately. Ensure the documentation is easily accessible to employees and stakeholders who need to reference the updated information.

- Continuous improvement: Promote a culture of constant improvement by actively seeking feedback, monitoring the impact of changes, and fostering an environment that encourages innovation and adaptation. Regularly assess the effectiveness of change management processes and make necessary adjustments to enhance compliance and accuracy.

Managing changes and modifications requires careful planning, collaboration, and monitoring. It is essential to balance agility and control to ensure that changes are implemented smoothly while minimizing risks and maintaining compliance and accuracy.

Deferred Revenue and Recognition Methods

Deferred revenue is when a company receives payment from a customer for goods or services that have not yet been delivered or earned. It represents an obligation to provide the product or service in the future.

Companies use different recognition methods based on Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) to account for deferred revenue appropriately. Two standard recognition methods are the “Percentage of Completion” and the “Completed Contract” methods. Let’s explore these methods further:

- Percentage of Completion (POC) Method: The POC method recognizes revenue proportionally as work progresses on a long-term project. It is commonly used when a long-term contract or project spans multiple accounting periods. Under this method, revenue is recognized based on the project completion percentage. The completion percentage can be determined by costs incurred, physical progress, or milestones achieved.

The formula for recognizing revenue using the POC method is Revenue recognized = Total contract revenue × Percentage of completion completed. - Contract Method: The Completed Contract method defers revenue recognition until the project is substantially complete or when specific conditions are met. This method recognizes revenue and related costs only when the contract is completed. It is typically used when the outcome of a project can only be reliably estimated once it is finished.

The formula for recognizing revenue using the Completed Contract method is Revenue recognized = Total contract revenue. Costs incurredIt’s essential to note that the use of each method depends on the specific circumstances and the company’s accounting policies. Companies should carefully evaluate which way is appropriate for their situation and ensure compliance with applicable accounting standards.

Additionally, it’s worth mentioning the “Subscription-Based Revenue Recognition” method, which is commonly used by companies offering subscription-based services or software. Under this method, revenue from subscriptions is recognized over the subscription period based on a systematic allocation approach. The payment is recognized in equal or varying amounts over the subscription period to reflect the delivery of services or access to the software.

It’s advisable to consult with accounting professionals or refer to specific accounting standards, such as the Financial Accounting Standards Board (FASB) guidelines in the United States or International Financial Reporting Standards (IFRS), for detailed and up-to-date guidance on revenue recognition and deferred revenue for your specific jurisdiction and industry.

Ensuring Compliance and Accuracy

Compliance and accuracy are crucial in various aspects of business and decision-making processes. Whether it’s adhering to legal regulations, maintaining data accuracy, or conducting reliable research, here are some general guidelines to ensure compliance and accuracy:

- Understand the regulations: Familiarize yourself with relevant laws, regulations, and industry standards that apply to your field. Stay up-to-date with any changes or updates to ensure compliance.

- Establish clear policies and procedures: Develop clear guidelines and procedures that outline how tasks should be performed accurately and in compliance with regulations. Communicate these policies effectively to all relevant stakeholders.

- Training and education: Provide regular training sessions to educate employees about compliance requirements, accuracy expectations, and best practices. Ensure that employees understand their roles and responsibilities in maintaining compliance and accuracy.

- Documentation and record-keeping: Maintain detailed records of activities, processes, and decisions. This documentation is evidence of compliance and accuracy and can be helpful during audits or investigations.

- Implement internal controls: Establish internal controls such as segregation of duties, authorization processes, and checks and balances to prevent errors, fraud, or non-compliance. Regularly review and update these controls to address any identified weaknesses.

- Quality assurance and review processes: Implement robust quality assurance procedures to review and validate data, reports, and outputs. Conduct regular audits and reviews to identify and correct inaccuracies or compliance issues.

- Data validation and verification: Implement mechanisms to validate and verify data accuracy, such as using automated tools, conducting sample checks, or employing independent third-party audits.

- Ethical research practices: If you’re involved in research or data analysis, follow ethical research practices, including proper data collection, unbiased analysis, and accurate reporting. Adhere to research protocols and guidelines to ensure accuracy and compliance with research standards.

- Stay informed and adapt: Keep yourself updated with changes in regulations, industry best practices, and technological advancements. Regularly assess and improve your processes to align with the latest compliance requirements and accuracy standards.

- Encourage reporting and feedback: Establish a culture of open communication where employees are encouraged to report any compliance concerns or inaccuracies. Provide channels for anonymous reporting to mitigate potential risks and address issues promptly.

Remember, ensuring compliance and accuracy is an ongoing process that requires vigilance, adaptability, and continuous improvement. Regular monitoring, evaluation, and feedback loops are essential to maintain high standards and mitigate potential risks.

Documentation and Audit Trail

Documentation and maintaining an audit trail are essential to ensuring compliance and accuracy in various contexts, such as legal and regulatory compliance, financial processes, quality management, and data management. Here are some key points to consider when it comes to documentation and creating an audit trail:

- Document everything: Maintain detailed and accurate records of all relevant activities, transactions, decisions, and processes. This includes financial transactions, contractual agreements, operational procedures, policy changes, and other significant events.

- Standardize documentation: Establish standardized formats and templates to ensure consistency and ease of understanding. Clearly define fields or sections to capture necessary information such as dates, participants, descriptions, and outcomes.

- Timestamps and signatures: Include timestamps on documents and require appropriate signatures or authorizations to establish the authenticity and accountability of the recorded information.

- Version control: Implement version control mechanisms to track document changes and revisions. Maintain a clear record of document versions and ensure the most up-to-date version is easily accessible.

- Storage and organization: Establish a secure and organized system for storing and retrieving documents. Consider using electronic document management systems or cloud-based platforms that offer features like access controls, search capabilities, and backups to ensure data integrity and availability.

- Access controls and permissions: Implement access controls to restrict document access based on roles and responsibilities. Ensure that only authorized individuals can view, modify, or delete documents to maintain data confidentiality and prevent unauthorized changes.

- Retention policies: Develop retention policies that define how long different documents should be retained. These policies should comply with legal and regulatory requirements. Dispose of documents securely and by applicable guidelines once they are no longer needed.

- Audit trail creation: Establish mechanisms to capture and maintain an audit trail of activities and changes made to documents. An audit trail records key information such as who made the changes when they were made, and the nature of the changes. This helps track document modifications’ history and provides an additional layer of accountability.

- Regular audits and reviews: Conduct periodic audits and inspections of your documentation and audit trail processes to ensure compliance, accuracy, and completeness. This helps identify any gaps or inconsistencies that need to be addressed.

- Training and awareness: Provide training to employees on the importance of documentation, proper record-keeping practices, and the use of the audit trail. Create awareness about the role of documentation in compliance and accuracy and emphasize the need for adherence to established procedures.

Remember that the requirements for documentation and audit trails may vary depending on the industry, regulatory environment, and organizational needs. It’s essential to align your documentation practices with the applicable standards and guidelines relevant to your context.